According to the monthly report released by the International Cocoa Organization (ICCO), in the first quarter of the 2021/22 year (October-December 2021), cocoa demand in major regions of the world showed a strong recovery. Despite the Covid-19 pandemic, advances in vaccination have allowed socio-economic opening up and boosted consumer demand for most commodities, including cocoa. ICCO expects cocoa consumption growth to accelerate in 2021/22 and 2022/23.

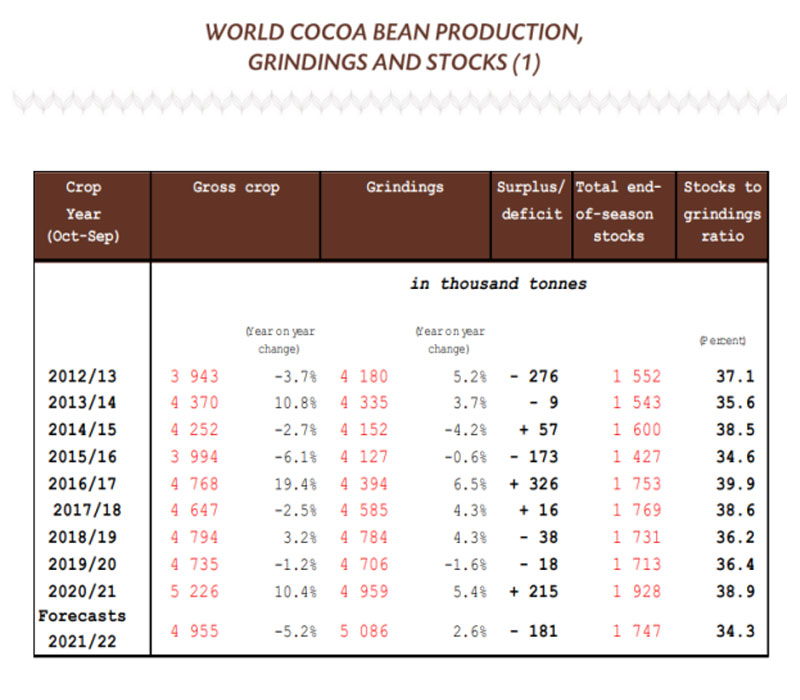

At the same time, cocoa prices have not been under pressure due to oversupply and ample inventories over the past year, which has allowed chocolate brands to control costs and increase cocoa processing activities.

Growing Demand for Cocoa Grinding

European cocoa grinding demand in the fourth quarter of 2021 increased by 6.3% year-on-year to 365,826 tonnes, according to regional cocoa association data. Asian cocoa grinding demand increased by 6.3% year-on-year to 231,309 tons. However, the demand for cocoa grinding in the United States decreased slightly by 1.2% to 116,614 tons, but it is worth noting that the number of cocoa grinding factories in the United States has decreased from 17 to 16. It is not yet known whether the only reason for the decrease in grinding demand data.

Cocoa Production Trends in Côte d’Ivoire and Ghana are Opposite

Contrary to the marked increase in cocoa grinding demand, cocoa production performance has been relatively modest. Cocoa production in Côte d’Ivoire, the world’s largest cocoa producer, has exceeded the level of the same period last year. Cocoa production as of January 30 was 1.34 million tonnes, up 1.5% from 1.32 million tonnes in the same period last year. But the bad news is that drier weather in cocoa-producing regions could reduce good soil moisture, raising concerns about the yield and quality of crops scheduled for later in the season.

Meanwhile, Ghana’s new year’s cocoa production is not optimistic. As of January 6, the country’s cocoa production fell sharply by 53.9% to 263,000 tonnes from 570,000 tonnes last year. The main reason for the sharp drop in cocoa production in the country is the disruption of traffic in the Ashanti region, the second largest cocoa producing region. Similar to neighbouring Côte d’Ivoire, there is currently insufficient rainfall and dry winds.

Cocoa Price Trend: Steady Rising

Increased demand and reduced production would theoretically push cocoa prices higher, but ample cocoa inventories have restrained rapid price increases. But under the general trend of global inflation, we expect a steady upward trend in cocoa prices.